When it comes to home improvement projects such as installing the LeafFilter gutter protection system, many homeowners may be wondering whether the cost of installation is tax deductible. This article will provide an overview of LeafFilter and outline possible deductions, rules, and regulations that may apply when considering LeafFilter as a tax-deductible item.

Definition of LeafFilter

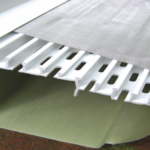

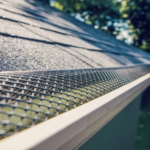

LeafFilter is a product designed to reduce damage that clogged gutters often create. LeafFilter’s patented gutter protection system helps prevent damage from happening by diverting rainwater away from your home and structural foundation – thereby protecting against water leakage and landscape erosion.

LeafFilter’s unique design employs a “micromesh” technology that blocks debris such as leaves, pine needles, roof sand-grit, sticks, twigs and other elements out of your gutter while still allowing water to safely drain away from the home. This fundamental principle of leaf filtration creates an effective barrier between debris and your gutters. As a result, gutters are kept clean while preventing unwelcome pests such as mosquitoes and birds from entering the system. The worry-free design is easy to install with no obstructions or modifications to the existing structure of your home.

Tax Deductibility

The decision to install a LeafFilter system is likely an investment in the preservation of your property value. While the cost of installation may be significant, the United States Internal Revenue Service may allow you to recoup part of the cost by listing it as a tax deduction.

We now take a close look at the tax deductibility of LeafFilter and the specific requirements for eligibility:

Overview of IRS Tax Deduction Qualifications

In the United States, taxpayers who purchase and install the LeafFilter gutter protection system may be eligible to take a federal income tax deduction for the cost of their purchase, as well as for any costs associated with repairs necessary to keep the LeafFilter system functioning properly. The Internal Revenue Service (IRS) allows taxpayers to claim deductions on various property-related expenses, including home improvements. However, it is important to understand exactly which deductions are permitted and which are not.

The following guidelines can help you determine if your LeafFilter purchase and installation qualify for a deduction:

- In order for your purchase or repair costs to be treated as a qualifying expense under IRS guidelines, the installation or repair must be made to a property that is either a business or qualifies as a residential rental home or primary residence.

- The item must add value or extend the life of an existing structure in order to qualify as an expense that can be deducted.

- For business expenses related to LeafFilter’s installation, generally they must relate directly and exclusively to the trade or business activity of that taxpayer in order for it to qualify as a deductible business expense under U.S. tax law.

- Finally, depending upon when you had purchased and installed your leaf filters and when you file for taxes; credits may apply such as energy credits if applicable in your area by law.

It is always smart before making any decisions regarding tax deductibility, just contact an experienced certified public accountant (CPA) who can advise you on your individual tax situation and create documentation around this decision if needed.

Is LeafFilter Tax Deductible?

When it comes to taxes, many people are unsure of what can and cannot be deducted from their taxable income. It’s important to remember that the Internal Revenue Service (IRS) dictates which expenses can be claimed on your tax return. LeafFilter Gutter Protection is an expense that may or may not be able to be deducted, depending on the circumstances of your installation.

When LeafFilter is installed as part of a remodeling project or home improvement, it will likely qualify as a tax-deductible expense. However, this deduction must follow certain IRS regulations such as those related to capital improvement costs and the maximum deduction allowable in any given year. Additionally, if you can show that LeafFilter prevents medical problems (such as reducing back pain from roof cleaning tasks), you may deduct those costs provided proper documentation is submitted with your annual tax return.

In some cases, you may also qualify for an energy credit if the installation involves the replacement of existing gutter covers with a more efficient one or if the installation helps reduce your energy bills overall due to improved insulation around windows or doors due to new gutter covers. However, in order for this credit to apply, you must find a professional Energy Star contractor who has earned certification from either Energy Star or Building Performance Institute (BPI).

In summary, whether LeafFilter expenses will be deductible depends on many individual factors and should always be discussed with an experienced tax representative before submitting your annual tax return.

Benefits of LeafFilter

LeafFilter is a gutter protection system that prevents leaves, pine needles and other debris from entering your gutters. The system is designed with your home in mind and helps to provide a maintenance-free gutter solution. Additionally, it is tax-deductible and offers a variety of other benefits.

Let’s take a closer look at all of the advantages that come with using LeafFilter:

Overview of LeafFilter Benefits

LeafFilter is a gutter guard protection system designed to keep leaves and other debris from clogging your gutters. It is the perfect maintenance-free solution for homeowners wanting to keep their gutters free of debris, reduce their home maintenance time, and prevent costly repairs. The Leaffilter system works by filtering out debris before it has a chance to enter the gutter system and cause damage.

The benefits of LeafFilter include:

- Protection against gutter clogs – LeafFilter offers maximum protection against leaves and other objects from entering your gutters, saving you time and money on future cleaning or repairs.

- Durability & Weatherproofing – LeafFilter’s stainless steel mesh filters are made to withstand the harshestweather conditions while its patented louver design prevents overflow caused by heavy rainstorms or snow melt.

- Easy installation – The LeafFilter system can be installed into existing gutters within one day with minimal mess and disruption, making it an economical choice when compared to replacing existing gutter systems entirely.

- Cost Savings – Not only will you save money on future cleaning and repair costs by installing Leaffilter, many homeowners may also be eligible for tax deductions as installation fees are often tax deductible as a home improvement expense.

Benefits of LeafFilter Tax Deductibility

LeafFilter is an effective gutter guard system that attaches to existing gutters, preventing water and debris from clogging and overflowing during heavy rains. Not only does this provide invaluable protection for the home, but it can also provide a tax deduction for many homeowners.

When it comes to tax deductions for LeafFilter, the answer depends on which type of coverage you purchase from your retailer. Depending on what coverage you receive, it may be possible to deduct certain expenses associated with LeafFilter installation and maintenance. A qualified accountant can help you determine what may be deductible in your situation.

For instance, LeafFilter’s full-coverage plans offer leak repair protection, meaning you will not have to pay out of pocket for any necessary repairs in the future. Certain repair costs related to this coverage may be eligible for deductions when filing your taxes, saving you money and time in the long run. Additionally, depending on the area where you live, some sales taxes associated with purchasing LeafFilter may be eligible for tax deductions as well.

Though excellent gutter protection is reason enough to purchase a LeafFilter system, knowing that certain costs connected to its installation and maintenance could potentially provide a tax deduction is certainly an added bonus as well.

Conclusion

After evaluating the available information, it appears that LeafFilter gutter protection is eligible for tax deduction in certain cases. In general, if a homeowner has paid for the LeafFilter product with their own funds and not through an insurance, the product cost and all associated installation costs could be eligible for a tax deduction.

It is important to consult with a tax professional to ensure that all of the relevant details are taken into account.

Summary of LeafFilter Tax Deductibility

LeafFilter is a micromesh gutter protection system designed to keep debris out of your gutters, ensuring that rainwater and melted snow will be channeled and diverted away from your home. Many homeowners are interested in learning if the cost of LeafFilter is tax-deductible.

The short answer to this question is no. The cost associated with purchasing, installing, and maintaining LeafFilter gutter protection will not qualify as a valid expense under the IRS tax code and will not be eligible for any type of deduction. Additionally, LeafFilter gutter guards are not considered an eligible home improvement expense by the Internal Revenue Service (IRS). Therefore, the cost incurred when purchasing a LeafFilter system cannot be used as an income tax deduction, either in a current or future tax year.

However, buyers may still find ways to effectively reduce their taxable income through other available means such as:

- energy efficiency credits

- certain types of government incentives

Ultimately, it’s wise to consult with a tax professional before attempting any deductions related to LeafFilter purchases or installation services in order to ensure compliance with IRS regulations.

Frequently Asked Questions

Q: Is leaffilter tax deductable?

A: LeafFilter Gutter Protection does not qualify as a tax deductible expense.